Why Travel Insurance Matters After 60

Outline

– Peace of mind while traveling after 60: what it means and how to achieve it

– The core components of travel insurance and how they work in real life

– Comparing policy types and costs for value and fit

– Senior-specific considerations: pre-existing conditions, medical limits, evacuation

– A practical checklist and conclusion to turn planning into confidence

Peace of Mind After 60: What It Really Means on the Road

Peace of mind isn’t a luxury add-on to your itinerary; it is part of the luggage you carry every time you leave home. After 60, it becomes both practical and personal. It is the knowledge that a missed connection won’t unravel a long-awaited tour, that a sudden illness won’t force impossible choices, and that you can focus on conversations and sunsets instead of paperwork and bills. In other words, peace of mind is a plan—backed by information, preparation, and the right coverage—so small hassles stay small and rare big problems do not become financial shocks.

Travel has many moving parts, and the odds of something going sideways are not trivial. In busy regions, roughly one in five flights can be delayed in a typical year, and baggage mishandling, while uncommon, still affects millions of bags globally. Medical costs vary wildly by country and city; a single emergency visit can exceed a thousand dollars, and overnight stays may multiply that quickly. Medical evacuation is the most dramatic example: depending on distance and aircraft type, it can range from tens of thousands to well over a hundred thousand dollars. These are not scare stories—just realistic price tags that explain why insurance is a key tool for travelers who prefer certainty over chance.

What does peace of mind actually look like in practice? It blends planning, communication, and cover:

– Planning: keep copies of travel documents, prescriptions, and key contacts; share itineraries with a trusted person at home; know your policy number and emergency line.

– Communication: learn how to describe symptoms succinctly, carry a medication list, and confirm your phone’s international capability.

– Cover: choose a policy that aligns with your destinations, activities, and health profile, so you are not underinsured where you need help most.

Finally, peace of mind is the habit of asking calm, helpful questions before you go: If my bag disappears for two days, what’s my plan? If I slip on wet stairs, who coordinates care? If a storm cancels my flight, how are extra nights arranged and paid? Travel insurance does not eliminate uncertainty, but it replaces improvisation with a roadmap—the difference between a detour and a derailment.

The Building Blocks of Travel Insurance, Explained Clearly

Travel insurance is a bundle of safeguards that step in when common risks interrupt your plans or your health. While details vary, most policies revolve around several pillars: trip cancellation, trip interruption, travel delay, baggage cover, emergency medical expenses, medical evacuation and repatriation, personal liability, and 24/7 assistance. Understanding the triggers and limits of each pillar helps you choose with intention rather than guesswork.

Trip cancellation reimburses prepaid, nonrefundable costs when a covered reason forces you to cancel before departure. Covered reasons typically include a serious new illness or injury, a family emergency, severe weather, or significant travel provider disruptions. Trip interruption is the mid-journey sibling, covering unused portions of a trip and extra return costs when you must cut travel short. Travel delay offers a daily stipend for meals and lodging after a specified delay threshold, usually several hours; think of it as a buffer against lengthy layovers you did not plan.

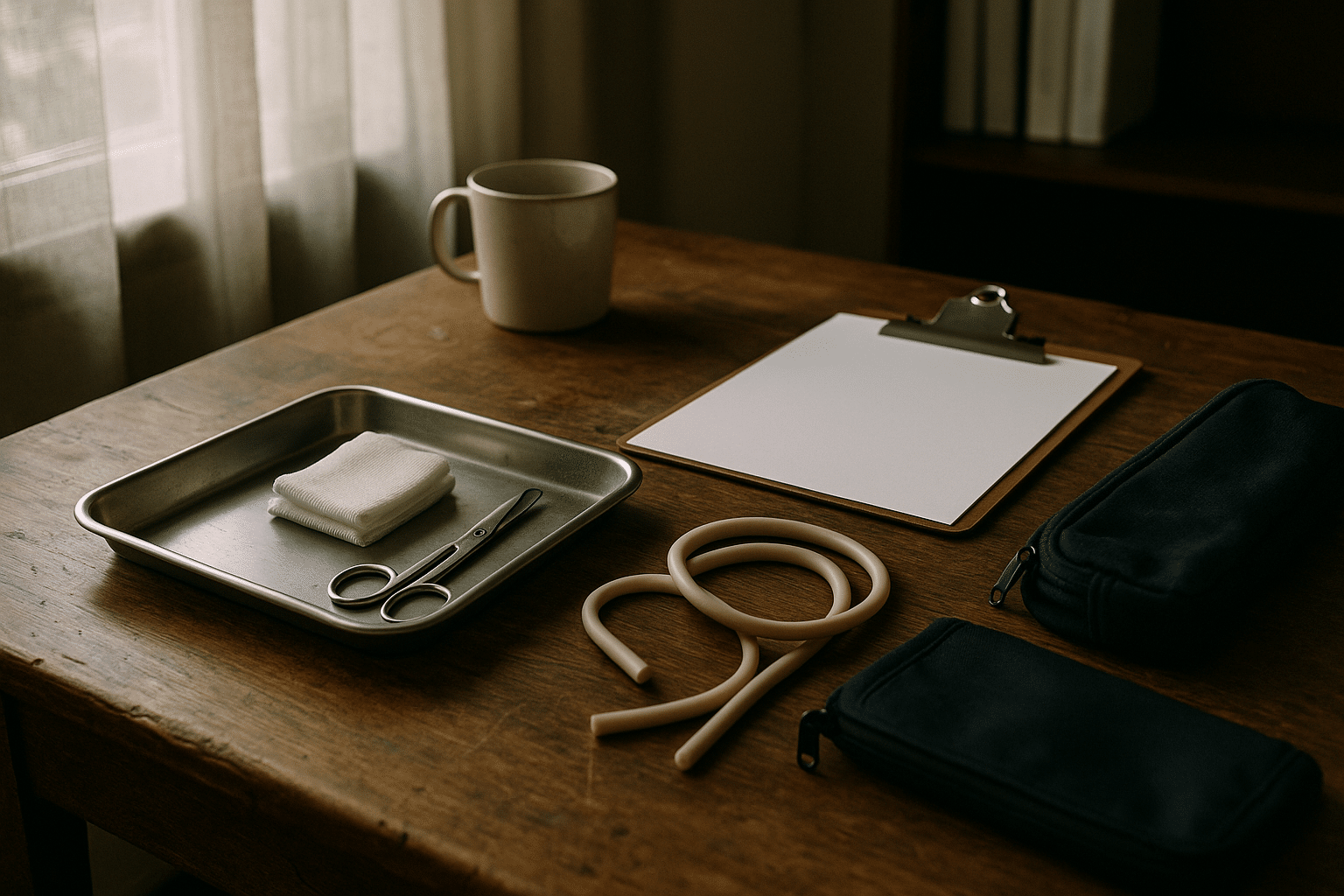

Baggage coverage addresses lost, stolen, or damaged items, and often includes delay benefits that help you buy essentials when your suitcase takes the scenic route. Many policies cap electronics and jewelry at modest amounts, so keep receipts and consider leaving irreplaceable valuables at home. Emergency medical coverage is the cornerstone for seniors traveling internationally, as domestic health plans may offer limited or no overseas benefits. Look for adequate per-person limits that reflect local costs in your destination; emergency rooms, diagnostic imaging, or specialist consultations can add up quickly.

Medical evacuation and repatriation fund medically necessary transport to the nearest appropriate facility—or home if warranted under the policy. This benefit is crucial when care nearby is limited or when distances are vast. Assistance services tie everything together: a multilingual team can help locate clinics, arrange direct payment when possible, coordinate prescriptions, and brief you on next steps.

What travel insurance can and cannot do:

– Can: reimburse covered losses, coordinate care, and reduce out-of-pocket shocks.

– Can: provide a single emergency phone number and guidance in unfamiliar systems.

– Cannot: pay for every scenario; exclusions often include risky activities, intoxication, or foreseeable events already publicized before purchase.

– Cannot: guarantee upgrades or conveniences; it aims to restore you, not improve your booking.

That realism is your ally. A policy’s value comes from clearly stated triggers, sensible limits, and service you can actually reach—features that convert uncertainty into manageable inconvenience.

Comparing Policy Types and Costs Without the Headache

Not all travel insurance is built for the same trip. The right fit depends on how often you travel, where you are going, and what you have at risk financially. A single-trip policy is tailored to a specific itinerary with defined dates; it is straightforward and often cost-effective for occasional travelers. An annual multi-trip policy covers every journey within a year, typically with a maximum length per trip; it suits those who take multiple getaways or combine personal and family visits across seasons.

Coverage scope matters as much as format. A comprehensive policy generally bundles cancellation, interruption, delay, baggage, medical, and evacuation. A medical-only policy focuses on health and evacuation, forgoing trip cost protection; this can be attractive if your travel purchases are flexible or refundable. For domestic travel, you might lean on your existing health coverage and opt for a lighter policy that addresses trip costs and delays. For international travel, stronger medical and evacuation limits are prudent.

Costs scale with age, trip price, destination risk, and coverage limits. As a broad frame, comprehensive coverage can run from a small single-digit percentage of the insured trip cost into the teens for older travelers and high-risk destinations. Medical-only plans are often priced as a flat fee driven by age and trip length. Consider an example: a $4,000 ocean voyage for a traveler in their late sixties. A comprehensive plan might range from a few hundred to higher, depending on cancellation limits, medical caps, and optional upgrades; a medical-only policy could be notably lower but would not refund prepaid fares if you cancel for a covered reason.

How to compare with clarity:

– Match limits to reality: medical limits in the six figures can make sense abroad; evacuation amounts should cover long-distance transport.

– Check deductibles and whether coverage is primary or secondary; primary pays first and can simplify claims.

– Read eligibility rules by age; some plans cap benefits or require questionnaires past certain thresholds.

– Weigh extras: rental car cover, adventure-sports riders, or cancel-for-any-reason upgrades increase flexibility at added cost.

Finally, look beyond price. A slightly higher premium that eliminates a key exclusion or increases a limit can be a better value than a cheaper policy that leaves important gaps. Your goal is fit, not flash.

Travel Insurance for Seniors: Fine Print That Protects Your Plans

For travelers over 60, the most consequential pages of a policy are often the ones many skip: eligibility, pre-existing conditions, and exclusions. Pre-existing conditions clauses typically define a look-back period—commonly weeks to months before purchase—during which a condition must be stable with no new symptoms, medication changes, or treatments to qualify for coverage. Some policies offer a waiver if you buy soon after your first trip payment, meet resident and fitness-to-travel requirements, and insure the full nonrefundable cost. The practical takeaway is timing: purchase early to keep the widest path to coverage.

Medical limits deserve special attention. For international travel, robust emergency medical limits—often in the low to mid six figures—can keep care accessible without deep out-of-pocket payments. Evacuation limits may need to be higher still, especially for remote regions or itineraries spanning oceans and mountains. If mobility aids are part of your daily life, check whether the policy treats them as baggage or as medical equipment; coverage, caps, and claims documentation may differ. Prescription continuity is another factor: assistance services can help locate replacements, but you still need a list of medications, dosages, and generic names.

Age-related rules vary. Some policies extend full coverage with age-based pricing; others impose maximum ages for certain benefits or require medical questionnaires. Screen for clauses concerning adventure activities, altitude limits, or participation in organized sports; if a scenic hike becomes a steep trek, you want to know where your coverage stands. When traveling with adult children or grandchildren, confirm how family or companion definitions apply, as this affects interruption or cancellation when someone else on the reservation falls ill.

Documentation habits make claims smoother:

– Keep medical notes, receipts, and discharge summaries; ask providers to include dates, diagnoses, and treatment details.

– Save delay and cancellation proofs such as emails, screenshots of schedules, and written notices.

– Photograph damaged luggage and any serial numbers; log the time you reported issues to carriers and authorities.

Strategically, think in layers: your domestic health plan may provide some out-of-area protections, credit cards might offer narrow trip benefits, and travel insurance can tie gaps together with clear triggers and service coordination. That layered approach is particularly useful for seniors, whose needs may span medications, specialist visits, and the option to return home quickly if a family member needs care.

Checklist and Conclusion: Turning Planning Into Confidence

Choosing travel insurance is easier when you turn a big decision into a series of small, sensible steps. Start with a risk sketch: destination health standards, weather season, trip cost, refundable versus nonrefundable payments, and any planned activities with extra risk. Layer your personal profile on top: current conditions, medications, mobility needs, and whether you are traveling with companions who might affect your plans.

Next, match benefits to the sketch. Aim for medical and evacuation limits that reflect actual prices where you are going; long-haul evacuation and private transport can surge costs quickly. Decide whether cancellation is essential—if your deposits are large or your schedule is tight, it often is. If you want broad flexibility, consider upgrades that allow more reasons to cancel, recognizing they raise premiums and may refund a percentage rather than the full amount.

Time your purchase wisely: buying soon after your first trip payment tends to widen eligibility for pre-existing condition waivers and sets your coverage clock running for unforeseen events. Read the certificate, pausing on four areas—coverage, eligibility, limits, and exclusions—and jot a one-line summary of each in plain language for your own reference. Store your policy number, the 24/7 assistance contact, and a photo of your passport in a secure cloud folder you can reach from any device.

Practical quick list before you go:

– Confirm your phone can call internationally and test the assistance number once.

– Pack a medication list with generic names and dosages, plus spare glasses and a small first-aid kit.

– Photograph receipts for prepayments and major items; keep a basic expense log if delays occur.

– Tell a trusted contact where you are staying and when you plan to check in.

Conclusion for travelers over 60: Confidence comes from clarity. You do not need flawless predictions; you need a plan that absorbs surprises without derailing your journey. A thoughtful policy, purchased at the right time and matched to your real-world needs, lets you enjoy late-afternoon light on a new street, sip something warm, and feel the quiet assurance that if life tilts, you have a steady hand to help you right it. That is peace of mind you can pack, mile after mile.