How to choose travel insurance for seniors?

Travel is one of life’s great privileges at any age, and many older travelers have both the time and the curiosity to make the most of it. Yet a single unexpected event—a slip on wet steps, a sudden respiratory infection, a storm that diverts flights—can turn a dream trip into a costly detour. That’s where travel insurance earns its keep. For seniors, choosing wisely isn’t about fear; it’s about tailoring protection to your health profile, itinerary, and comfort with risk so the journey stays focused on discovery, not disruption.

Outline:

– Section 1: Why seniors benefit from travel insurance and the risks worth insuring.

– Section 2: Core coverage types (medical, evacuation, trip cancellation/interruption, baggage) and recommended limits.

– Section 3: Pre‑existing conditions, look‑back periods, and how waivers work in practice.

– Section 4: Comparing policies, pricing variables, and strategies to save without cutting essentials.

– Section 5: A practical checklist and closing guidance tailored to senior travelers.

Why Coverage Matters More After 60: Risks, Realities, and What’s at Stake

As travelers age, the probability of needing medical care on the road rises modestly, but the potential financial impact rises sharply. Many domestic health plans offer little or no protection outside your home country, and even when they do, reimbursement can be partial or slow. Overseas hospital stays commonly run hundreds to thousands of dollars per day, and medical evacuation—transport from a local facility to a hospital capable of providing appropriate care—can range from roughly $20,000 for short regional transfers to more than $100,000 for intercontinental air ambulance services. Those are numbers that can upend a retirement budget.

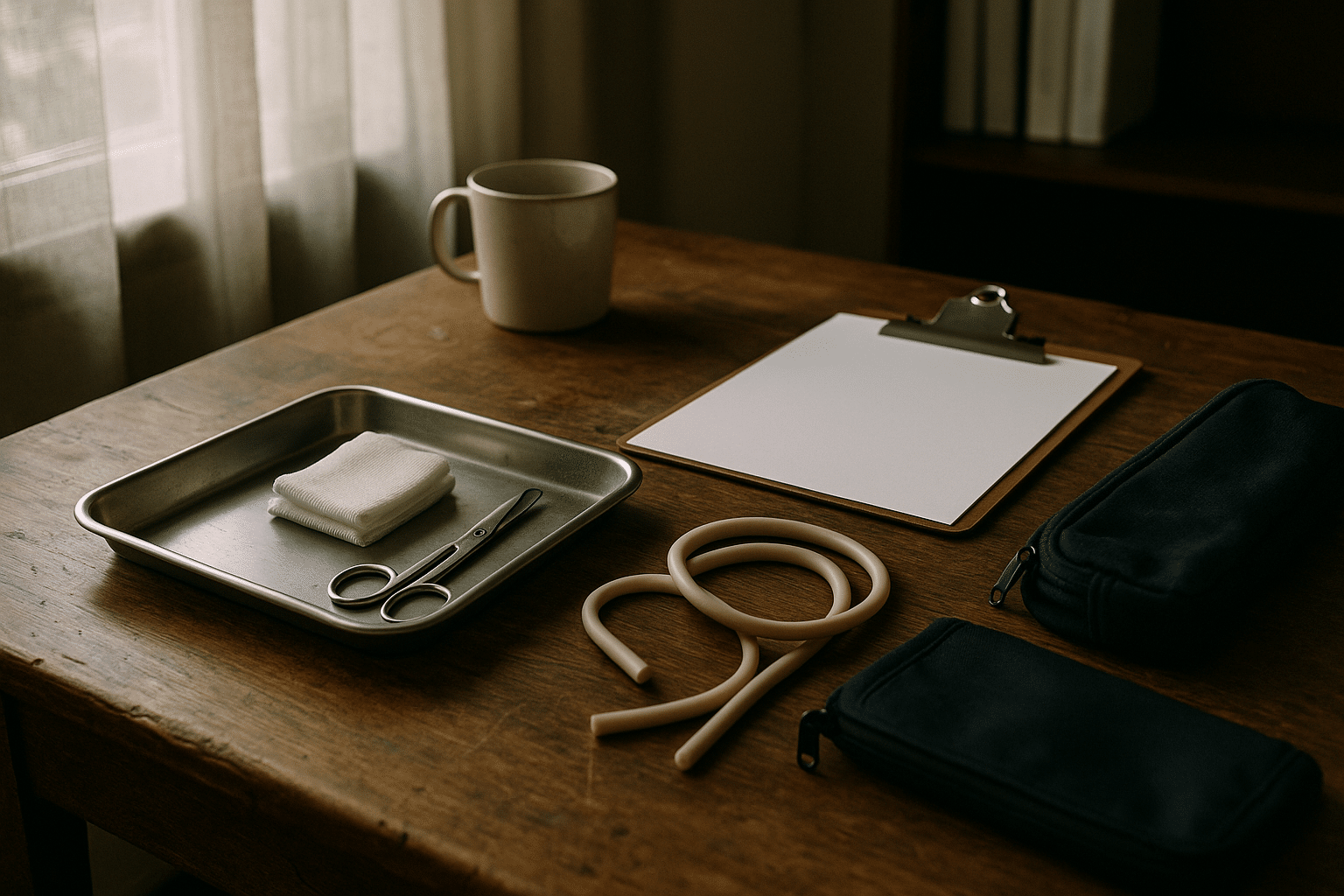

The risks worth insuring fall into a few familiar buckets. Medical issues often top the list: a flare in a chronic condition after a long flight, a fall on a cobblestone street, or food‑borne illness. Trip disruptions run a close second—weather systems, airline strikes, or a family emergency back home can force cancellations or shorten stays, turning nonrefundable bookings into losses. Then there’s baggage and personal items, where a lost bag can derail medication schedules or mobility aids. For seniors, the stakes are higher not only because of health considerations, but also because travel often involves carefully planned, higher‑value arrangements such as cruises, escorted tours, or multi‑segment itineraries.

Importantly, travel insurance is not one monolith; policies vary by age bands, medical underwriting rules, and benefit limits. For example, age‑rated pricing recognizes that claim likelihood changes over time, and some policies introduce caps or require medical screening above certain ages. Rather than view these differences as barriers, treat them as tools for customization. A relaxed week near home base might require modest coverage, while a remote expedition calls for more robust medical and evacuation limits. The goal is balance: enough protection to absorb plausible shocks, without paying for features you won’t use.

Key takeaways for seniors:

– Medical bills abroad can be substantial, and evacuation is the cost wildcard.

– Domestic health plans often don’t travel well; don’t assume automatic coverage.

– Policy variability by age is normal—look for transparent limits and eligibility.

– Match your policy to trip complexity, destination remoteness, and personal health.

The Core Benefits: How Much Medical, Evacuation, and Trip Protection Do You Need?

Travel insurance benefits cluster into several categories, and choosing appropriate limits is half the work. Start with emergency medical coverage. For international trips, many seniors target at least $100,000 in medical benefits, with higher limits (e.g., $250,000 or more) prudent for destinations with high private‑care costs or for itineraries far from major hospitals. Look for coverage that includes physician visits, hospital stays, diagnostics, prescription drugs, and dental emergency care. Policies that pay “primary” benefits settle eligible medical charges without waiting for other insurers; “secondary” policies coordinate after any other coverage you might have. Primary can simplify claims and cash flow on the road.

Medical evacuation and repatriation is the second pillar. Because aircraft, medical staff, and logistics drive cost, limits should be generous where distances are long or infrastructure is limited. A commonly cited benchmark is $250,000 in evacuation benefits for international travel, with some travelers preferring higher limits for remote regions or ocean cruises. Confirm what triggers an evacuation, who decides the destination facility (you, the assistance provider, or treating physician), and whether transport home is included after stabilization.

Trip cancellation and interruption protect your financial investment. Cancellation typically reimburses prepaid, nonrefundable costs when you must cancel for a covered reason—serious illness or injury, a death in the family, severe weather, or jury duty are typical examples. Interruption applies after departure if you must cut the trip short; many policies offer up to 150% of insured trip cost to cover both lost days and the additional expense of rebooking return travel. For delay, look for per‑day stipends (for meals and lodging) after a threshold of hours, and for missed connection benefits that help you catch up to a tour or cruise.

Baggage and personal effects coverage reimburses for loss, theft, or damage, and can be particularly relevant if you rely on medical devices or custom eyewear. Typical caps range from several hundred to a few thousand dollars, with sub‑limits for specific items. Consider whether your homeowner’s policy already offers some protection and whether the travel policy includes coverage for delayed baggage essentials.

Useful decision cues:

– International travel with limited local care: prioritize higher medical and evacuation limits.

– Expensive, prepaid itineraries: insure the full nonrefundable amount for cancellation/interruption.

– Complex connections or winter travel: emphasize delay and missed connection benefits.

– Dependence on specialized gear: verify baggage limits and sub‑limits for devices.

Pre‑Existing Conditions, Look‑Backs, and Waivers: Navigating the Fine Print

Pre‑existing condition rules are the most consequential feature for many senior travelers. Insurers define a pre‑existing condition as any medical issue for which you sought advice, received treatment, had symptoms, or changed medication during a specified “look‑back” period before purchasing the policy—often 60 to 180 days. Without a waiver, claims tied to those conditions can be excluded, even if you were feeling well on your departure date. Understanding three elements—the look‑back period, the stability requirement, and the availability of a waiver—prevents unwelcome surprises.

A look‑back period is retrospective: the insurer reviews your recent medical history to see if the condition was active or managed. Stability language may require no new symptoms, no changes in prescribed medication (dosage or frequency), and no new treatments or diagnostic recommendations during that window. Some policies interpret routine follow‑ups as stable; others treat any adjustment as instability. Because definitions differ, read the exact wording and, if needed, ask the insurer pre‑sale for clarification in writing.

Many policies offer a pre‑existing condition waiver when you meet specific criteria. Common requirements include purchasing the policy within a short window after your first trip payment (often 10–21 days), insuring 100% of your nonrefundable trip costs, and being medically able to travel when you buy. A waiver typically neutralizes the look‑back exclusion for cancellation, interruption, and medical claims related to previously known conditions, restoring peace of mind for travelers managing chronic issues like cardiovascular disease, diabetes, or respiratory conditions.

Practical steps:

– Buy early: aim to purchase within two weeks of your initial deposit to qualify for a waiver.

– Document health status: keep records of stable periods, medication lists, and physician notes.

– Disclose accurately: answer health questions truthfully; omissions can void coverage.

– Clarify gray areas: ask how the policy treats routine medication changes or new tests.

Consider examples. Suppose you increased a blood pressure medication 45 days before purchase; a policy with a 60‑day look‑back and no waiver might exclude related claims. With a waiver, those claims could be covered if you met the timing and eligibility rules. Or imagine a gastrointestinal flare evaluated six months ago with no changes since; a policy with a 90‑day look‑back and stability requirement may treat it as stable, but confirm that interpretation before relying on it. In short, the words matter—learn them once, and you’ll choose with confidence thereafter.

Comparing Policies and Pricing: Value, Trade‑Offs, and When to Buy

Price alone doesn’t reveal a policy’s value, particularly for seniors. Premiums reflect insured trip cost, traveler age, trip length, destination, and optional upgrades. Two policies priced similarly can differ on key features—primary vs. secondary medical coverage, evacuation decision rights, or how quickly delay benefits kick in. A structured comparison prevents you from paying for flash while missing substance.

Start with your trip cost and timing. If your itinerary is fully refundable until close to departure, you can defer insuring it; once cancellation penalties apply, purchase promptly, especially if you want a pre‑existing condition waiver. If your plans span multiple getaways, compare single‑trip coverage with annual multi‑trip policies. Annual plans can offer cost efficiency if you take several trips per year of similar length, but check per‑trip duration caps (commonly 30–90 days) and medical limits.

Next, match coverage to destination risk. Urban centers with robust hospitals may allow moderate medical limits; remote islands or high‑altitude towns argue for more. Activities matter too. If you plan gentle trekking, mobility‑aid use, or guided excursions, verify that these are included and whether any “adventure” exclusions apply. Some policies exclude certain sports or require an add‑on for higher‑risk activities; conservative choices can still leave you well‑covered without paying for exclusions you’ll never approach.

Read the claim mechanics. What documentation is required for cancellation (physician’s statement), interruption (proof of schedule change), or baggage loss (property irregularity reports)? Are there per‑item sub‑limits? Is there a “free look” period—a short window after purchase when you can cancel the policy for a refund if it doesn’t suit? Know the assistance hotline’s availability and whether translation or provider referrals are offered.

Ways to save without under‑insuring:

– Insure only the nonrefundable portion of your trip cost.

– Choose a sensible deductible on medical benefits if available.

– Skip “cancel for any reason” unless you truly need the flexibility; it raises cost and often reimburses a percentage, not the full amount.

– Buy once major payments become nonrefundable to secure waiver eligibility and lock in coverage.

– Align policy duration tightly with travel dates; avoid paying for extra days you won’t use.

Finally, purchase from a source that clearly discloses policy wording before you pay, provides comparisons by benefit, and allows questions. Transparency is a silent feature that becomes invaluable if you ever need to file a claim.

Putting It All Together: A Senior Traveler’s Checklist and Closing Thoughts

At decision time, clarity beats complexity. A concise checklist keeps you focused on the essentials while honoring your personal comfort with risk. Use it as a pre‑purchase companion and a pre‑departure ritual.

Coverage checklist:

– Health profile: list chronic conditions, recent medication changes, and physician visits.

– Waiver window: confirm you are within the 10–21‑day purchase period after your first trip payment if you need a pre‑existing condition waiver.

– Limits: target medical coverage of at least $100,000 internationally and evacuation of $250,000 or more for remote routes.

– Trip cost: insure only nonrefundable amounts; update coverage if you add prepaid tours or excursions.

– Disruptions: verify delay thresholds, missed connection benefits, and interruption at 150% of trip cost if important to you.

– Baggage: check caps and sub‑limits; plan how you’ll replace essentials if bags are delayed.

Preparation checklist:

– Documents: carry digital and paper copies of the policy, assistance numbers, itineraries, and prescriptions.

– Medications: pack extra days’ supply split between carry‑on and checked bags; bring original packaging where possible.

– Contacts: share your policy details and emergency contacts with a trusted friend or family member.

– Payments: know how to pay abroad for care (credit card, local currency) and how to claim later.

– Expectations: understand that approvals for evacuation or major treatment typically flow through the insurer’s assistance team; call them early.

Closing thoughts for senior travelers: Insurance is not a guarantee that nothing will go wrong; it’s a plan for handling what might. The right policy is “fit‑for‑purpose”—aligned with your health, itinerary, and tolerance for uncertainty. Invest time up front to parse the fine print on pre‑existing conditions, evacuation triggers, and documentation. Favor clarity over extras you won’t use, and keep all records organized from booking to boarding. With those habits, insurance becomes a quiet companion rather than a question mark, leaving your energy for the moments that make travel unforgettable: morning light over a new city, the taste of a dish you can’t pronounce, and the easy confidence of knowing you’re prepared if life throws a curve.